Tax Nightmare

Tax season should not be as stressful as it is for business owners. Ideally, all businesses should start the year with a clear tax plan and follow it during the year so when they must file their taxes, the process should be a simple process.

Sometimes, however, unforeseen circumstances may require extra work. Nonetheless, there are some decisions that will almost guarantee major problems that end up on the business attorney’s desk.

The following two are the most common business accounting mistakes that cause legal battles. Read them and do not make them:

GETTING INTO DEBT (OR ACCEPTING SUPPLIES OR EQUIPMENT FROM THIRD PARTIES) WITHOUT WRITTEN TERMS.

This mistake is usually made by businesses facing decrease on cash flow. Problems from unwritten promises to pay may range from unexpected high interest rates to legal battles. Borrowing money, supplies or equipment. It may open the door to costly litigation. Borrowing, therefore, requires the approval of all the business’ owners. Moreover, the terms should be negotiated and reduced to writing. Even in the most desperate circumstances, when borrowing anything on behalf of your business, draft and execute at least a simple document that reflects the amount of the loan (or responsibility), the terms of repayment, and the calculation (or absence) of interest and always have the document reviewed by a professional.

UNCLEAR OR UNWRITTEN POLICY OF PAYMENT OF BUSINESS EXPENSES.

As a matter of course, your business should have a separate account and should pay for its expenses from its account. Nonetheless, there may be situations in which you, or your personnel, need to pay for business expenses.

In those cases, your business must have a reimbursement policy to refund the money spent by third parties. The most basic reimbursement policy should require the person requesting reimbursement of business expenses provides proof of payment, date, and a reason for the expense. Even the business owner must provide said reports. Otherwise, you are going to have a very upset accountant, and if you have business partners, you risk loosing their trust. Have your ducks in a row and always comply with this basic rule. You will have peace of mind and a happy accountant.

You may also like

La importancia de un evento para tu negocio y marca personal

Los beneficios de mostrar tu marca o negocio en un evento son enormes y se perciben no solo al momen

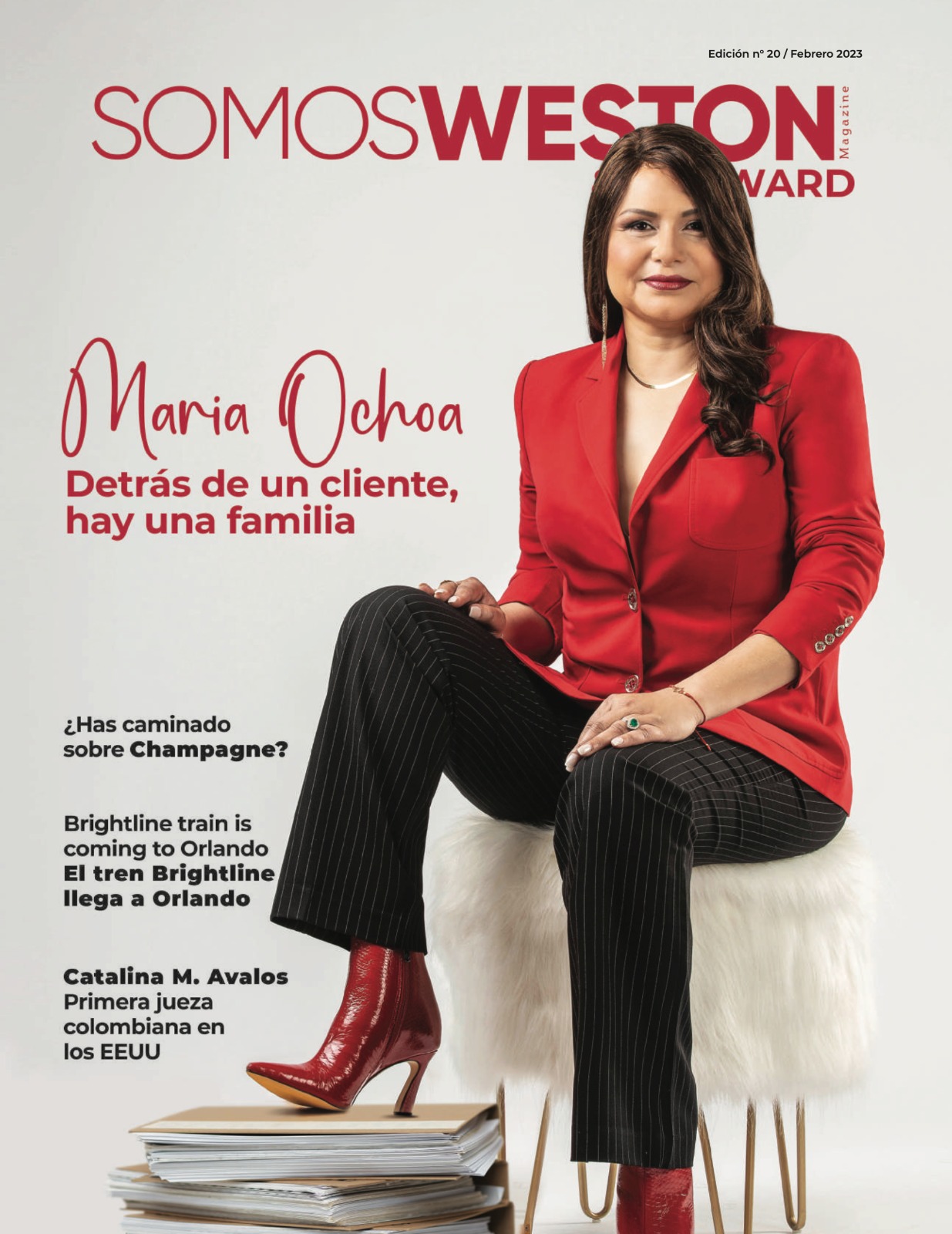

DETRAS DE UN CLIENTE HAY UNA FAMILIA

Gracias a una exitosa carrera profesional durante 25 años en el campo de bienes raíces, Maria Cori

NO HAY QUETENER UN CUERPOPERFECTO PARA BAILAR

Fuente: ChatGPT Beatriz Naranjo mas conocida como “Bea Azahar”, baila hace 20 años el “Bellyd